The global market for tablet processors is undergoing a significant expansion, with shipments expected to reach 299.7 million units this year. According to a new report from IHS Technology, this represents a 23 percent increase over the 243.1 million units shipped last year. The upward trajectory is forecast to continue with an 18 percent volume spike in 2015, eventually pushing the market past the 400 million unit mark by 2016.

This robust growth is attracting intense competition from suppliers eager to secure a foothold in the sector. While the market is currently led by an entrenched group of manufacturers with deep resources, including Samsung Electronics and Qualcomm, new players are beginning to join the race. These range from industry giant Intel to a variety of Chinese suppliers focused on the “white-box” market for lower-end devices.

Gerry Xu, senior analyst for processor research at IHS, noted that with Apple’s iPad, Samsung’s Galaxy, and other offerings selling well, “a number of vendors are starting to join the race to supply tablet processors for the market.”

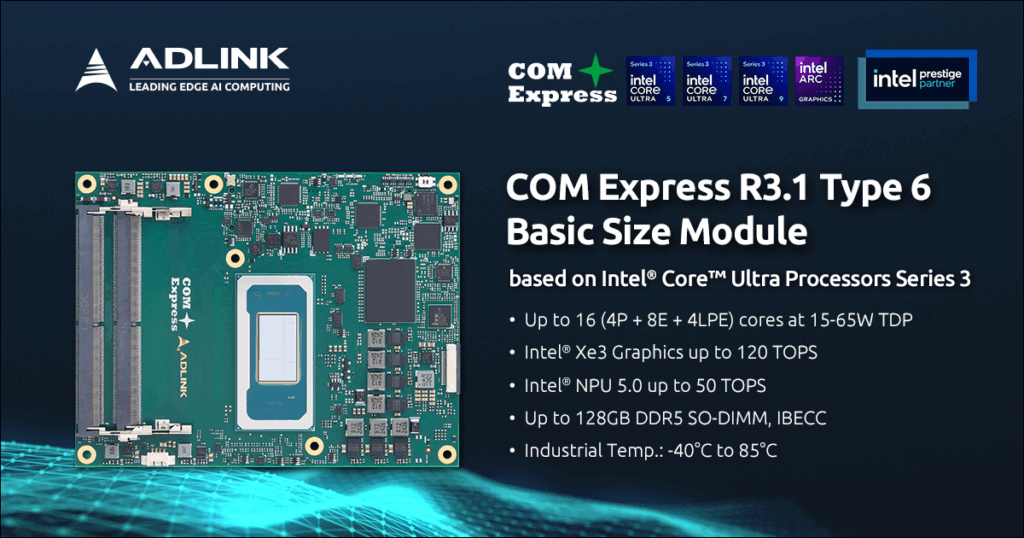

Intel has emerged as the highest-profile new competitor, targeting a broad spectrum of devices ranging from entry-level class to high-end models. The company’s Bay Trail processors are expected to appear in entry-level, 7- to 8-inch Android tablets as early as the first quarter. Future roadmaps include later generations such as the Cherry Trail and Willow Trail architectures.

A primary challenge for established players like Intel will be the entry-level segment, which currently accounts for one-third of the total market. This category is dominated by Chinese vendors such as Rockchip, Allwinner, and Amlogic. Additionally, Taiwan-based MediaTek, a major smartphone processor supplier, is looking to infiltrate the entry-level tablet space with highly competitive pricing.

Chinese manufacturers hold a distinct advantage through their handle on costs and the ability to provide turnkey chip solutions for generic white-box tablets. These devices can cost as little as $50, requiring processors to be priced significantly lower than those used by Tier 1 global brands.

Beyond the budget market, some Chinese vendors are now targeting the midrange segment, seeking design wins with global brands such as Lenovo and Hewlett-Packard. This shift toward higher-end hardware is expected to make the midrange processor field increasingly competitive.

Regarding the company’s strategic shift, Xu stated that the players range from “kingpin Intel, to a smattering of Chinese suppliers involved in the so-called white-box market for lower-end tablets.” Intel’s intent was further clarified during a November 2013 investor meeting, where executives indicated the company was entering the space to make chips for devices “from the entry-level class all the way to high-end tablet models.”